Macroeconomics (chpt15)

Macroeconomics is the study of the economy as a whole. Instead of looking at pieces like demand or supply, macroeconomics concerns itself with the big picture.

The diagram illustrates the economic cycle known as circular flow. People provide labor for businesses and in return are paid wages. People use wages to purchase goods and services from businesses for their homes.

Gross Domestic Product (GDP) is the total dollar value of all final goods and services produced by resources located within the same country in one year. GDP is a measurement used to determine the economic status of a nation. GDP measures and tracks how well the economy is doing relative to itself and other countries.

GDP is not perfect and cannot measure

1. The kinds of goods produced (tanks or pineapples);

2. The amount produced per person (if Nation A has fewer people but the same output as Nation B, Nation A is better off than Nation B that has more people because the “GDP per capita” is greater);

3. How goods are distributed; Is there a large middle class? Are there very few poor or many?

4. Changing price levels; Is there inflation? Deflation? Inflation is the condition in which the average level of prices increase.

5. Unpaid household work; (laundry, chauffeur, yard work, childcare, etc);

6. Barter (trading goods and services for other goods and services)

7, Quality of goods (inferior or superior quality)

8. Leisure time.

GDP is determined by four variables/inputs:

Consumer Spending Business Investments Government

Spending Net Exports/Foreign

Durable goods Equipment Federal Goods

Non-durable Plants State

Services Inventories Local

Thus this formula is useful: GDP = C + I + G + NE

Uses of Income: Income can be used for (1) Consumption, (2) Taxes, (3) Savings

Disposable income is what consumers may spend or save after taxes.

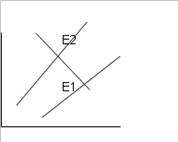

Aggregate demand is the total demand of all people for all goods and services produced in an economy. Likewise, aggregate supply is the total supply of all people for all goods and services produced in an economy.

Inflation (Chpt 17)

Inflation is the sustained rise in the average level of prices. This is also called a rise in the cost of living. Runaway inflation destroys an economy. Countries that suffer from excessive inflation become unstable economically and politically. The rise of the Nazis in Germany during the 1930s is partly attributable to the inflationary period of the German economy.

There are some who benefit from inflation. Debtors benefit because the loans that they take out become lower in value. For example if you took out a student loan for $10,000 and stayed in school for ten years, the value of $10,000 in ten years becomes less if there is inflation because your wages will increase during those ten years. Inflation hurts those who have fixed incomes the most because they have no real way to increase their income to match inflation. Thus if you receive a flat monthly income of $1000, what you can buy for $1000 becomes less and less over the years. Creditors are also hurt by inflation because the value of what they loaned out becomes increasing less valuable.

The rate of inflation is determined and measured by the Consumer Price Index (CPI). The CPI is comprised of a “basket of goods” of 400 items that include housing (40%), food and beverages (17%), transportation (17%), medical care (7%), apparel (6%), entertainment (5%), other (8%). Each year, the prices of these 400 good and services are added up and compared to the base that was determined by averaging the years 1982-1984. Thus, the CPI for 1950 was 24.1 which means that 1950’s CPI was 24.1% of the base. In other words, prices in 1950 were only 24.1% of the prices being paid in 1982-1984. The CPI for 2001 was 177.1, that is, prices in 2001 were 177.1% of the prices being paid in the base years (77% higher). See the CPI for the USA since 1913.

Rate of inflation =

New CPI – Old CPI

Old CPI

For example, using the data available at the link above,

2001 CPI (177) - 1985 CPI (107)

1985 CPI (107)

The cost of living has gone up 65.4% from the period of 1985 to the 2001. This is also called the “cost of living index.”

The limitations of CPI include (1) no one buys all 400 goods and services, (2) people who live in different parts of the country experience different costs of living, (3) it does not measure the quality of goods, (4) it does not include government services or taxation.

Demand-pull inflation is the rise in inflation due to a high level of aggregate demand in relation to aggregate supply. For example, people spent very little for goods during WWII and earned income that they could not spend because the goods went to the war effort. When the war ended, people had money to spend creating a shortage of goods. “Too many dollars chasing too few goods” is the common phrase use to illustrate demand-pull inflation. Another example would be a housing shortage in a popular area. There is a limited supply of houses being chased by people with money who want to live in the popular area.

Cost-push inflation is the rise in inflation due to an increase in the cost of production inputs. The rise in the cost of production is passed onto the consumer causing inflated prices. For example, if there is an increase in the cost of steel or an increase in the cost of labor, then cars will cost more to produce.